🧠 Can Numbers Reveal a Moat?

View Online | Sign Up | Advertise

Friends,

Last week, we made a YouTube video on UiPath’s earnings.

At the end of the video, we mentioned our upcoming webinar on Warren Buffett’s Financial Statements Rules of Thumb for detecting a moat.

One of our subscribers pushed back with an important critique:

|

|

While we agree with the spirit of this statement, we still believe that financial statement rules of thumb can be incredibly helpful.

That’s because there are more than 8,600 stocks listed on major U.S. exchanges alone. That’s far too many for any investor to research.

This is why knowing a few ‘rules of thumb’ is so useful. When combined with simple screening tools, a few ‘rules of thumb’ can drastically narrow your research list.

After that, you can start digging into the details.

Consider our favorite rule of thumb: stable / expanding gross margins.

Why is this rule of thumb so important? Consider this scenario:

Let’s say I bring a wildly popular product or service to market. When that happens, it will attract attention. Competitors will see my success and quickly bring a copycat product or service to market. They might be able to steal away some business from me if they charge less for it.

Without a moat, I’d face two bad choices: Lose business to my competitors or lower my prices.

If I choose the latter option, my income statement would reflect that decision by showing a narrowing gross margin.

This is why Buffett values a stable gross margin so highly. It’s a strong signal that the business has some kind of advantage that is fending off the competition.

To be clear, we don’t think ‘rules of thumb’ should be the end of the investing process. However, we think they are a great starting point that can eliminate a ton of unnecessary research.

After that, you can dive deep into the details to see if a company is truly investable.

Wishing you investing success,

– Brian Feroldi, Brian Stoffel, & Brian Withers

P.S. Want to learn more about Buffett’s 14 financial statement ‘rules of thumb’? Join us for a free webinar this Thursday (Sept 14th) at 12:00 PM EST. We’ll discuss the rules of thumb and practice using them with a few live examples.

Together With Convertkit:

Sponsor this Newsletter

Guess what? You’re reading promotional content in a newsletter. Sponsoring influencer newsletters, like mine, is a great way to reach engaged and targeted audiences. It will build your brand — whether that is your personal brand or your business.

The Long Term Mindset newsletter is part of the ConvertKit Sponsor Network. This network connects businesses to audiences of newsletter readers. For example, you can sponsor Long Term Mindset and connect with about ~80,000 people with similar interests to yours.

One Simple Graphic:

|

|

One Piece of Timeless Content:

Valuing early-stage businesses is always a challenge. Famed NYU Professor Aswath Damodaran breaks down his methodology in this timeless paper.

One Thread:

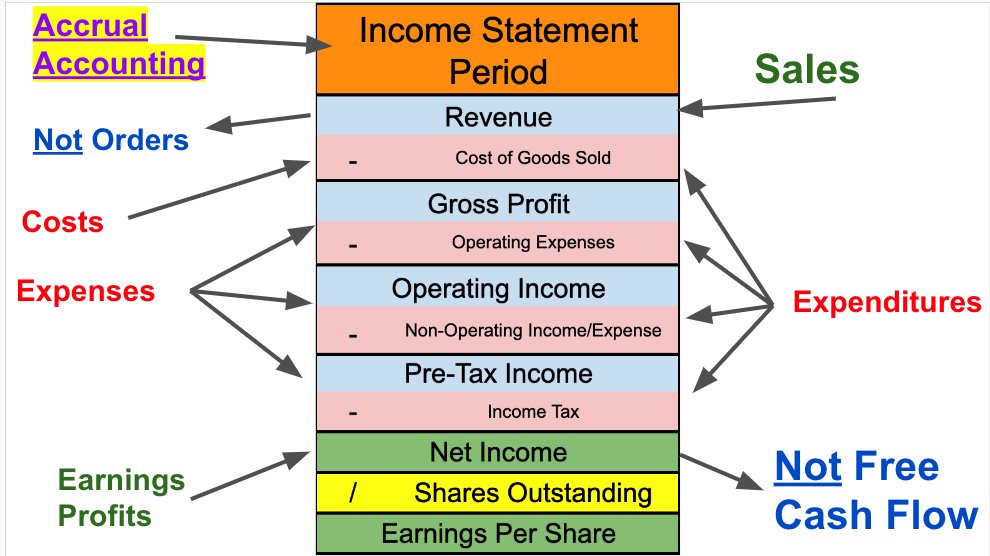

Accounting can be confusing. Feroldi breaks down the differences between some of the most confusing terms in this helpful thread:

|

One Resource:

Have you ever had a personal finance question and wondered if there was a calculator to help you decide? This website contains 20 calculators to help make decisions about credit cards, mortgages, tax, insurance, retirement, investing, small business, car buying, and more!

One Quote:

|

|

More From Us:

👨🎓 NEW! We’re launching a brand new course — Advanced Financial Statement Analysis — in October! See the details and join the waitlist.

📗 If you’ve read Brian Feroldi’s book, he’d love a review.

👨🎓 Need help getting your personal finances in order? Click here to start our 5-day Financial Wellness email course. It’s completely free.