🧠 Lessons From A $13 Billion Mistake

Click here to read in browser.

Friends,

My two favorite sectors to hunt for investment ideas are technology & healthcare (Feroldi here). This is why I’ve had my eye on Teladoc Health for years.

Despite the clear overlap in my investing sweet spot, I never became a Teladoc shareholder. Why? I was turned off by the company’s “growth by acquisition” strategy.

Teladoc boosted its growth rates for years by making acquisitions. While that caused it’s top-line to soar, that strategy is fraught with long-term risks.

Studies show that more roughly 80% of acquisitions fail to live up to their expectations. That’s due (in part) to management teams consistently overpaying for acquisitions and overestimating their odds of success.

Passing on Teladoc looked dumb for years. More recently, it’s looked savvy.

Last year, Teladoc was forced to take more than $13 billion worth of goodwill write-down charges. Translation: “we wayyyy over-paid for our acquisitions.”

For context, $13 billion is more than 3x larger than its $4 billlion market cap.

Teladoc’s rotten year contains many important investing lessons, but we think two are worth highlighting:

- Be wary of companies that grow by acquisition (especially when those companies are unprofitable)

- Valuation — even when done by professionals — is tricky

That second point is worth double-clicking on. It’s highly likely that Teladoc used complex valuation models created by highly-compensated investment bankers to show why its acquisitions made sense. But, the write-offs show just how quickly those valuation models can fall apart.

This highlights just how tricky it can be to value on a business. Even professional management teams and professional investment bankers can make enormous mistakes.

The task can be even more challenging for individual investors. Not only are there multiple valuation methods to master (TAM, DCF, Multiples…), but there are different valuation mindsets as well (VC, GARP, Growth…).

That’s a lot of information to consider.

Want some help? Join us on in March for new cohort-based course Valuation Explained Simply. This four-week course will provide a complete overview of the different valuation methods and mindsets, all explained in plain English.

If that interest you, use the code COUNTMEIN300 to receive the biggest discount we will offer. (This code expires on Sunday, March 5, at 11:59 pm EST.)

Wishing you investing success!

– Brian Feroldi, Brian Stoffel, & Brian Withers

In Partnership with ConvertKit

Newsletter Sponsorships Work

Guess what? You’re reading promotional content in a newsletter. Sponsoring influencer newsletters, like this one, is a great way to reach engaged and targeted audiences. It will build your brand — whether that is your personal brand or your business.

So here is the deal. This newsletter is part of the ConvertKit Sponsor Network (CKSN), representing more than 100 individual newsletter creators. Sponsor my newsletter and gain access to many more.

Sponsors Long-Term Mindset Now

One Simple Graphic:

|

|

One Piece of Timeless Content:

Selling a stock is one of the hardest decisions for investors, and can be the most costly. The Art of (Not) Selling by Chris Cerrone provides insight into how Akre Capital Management thinks about parting ways with an investment.

One Twitter Thread:

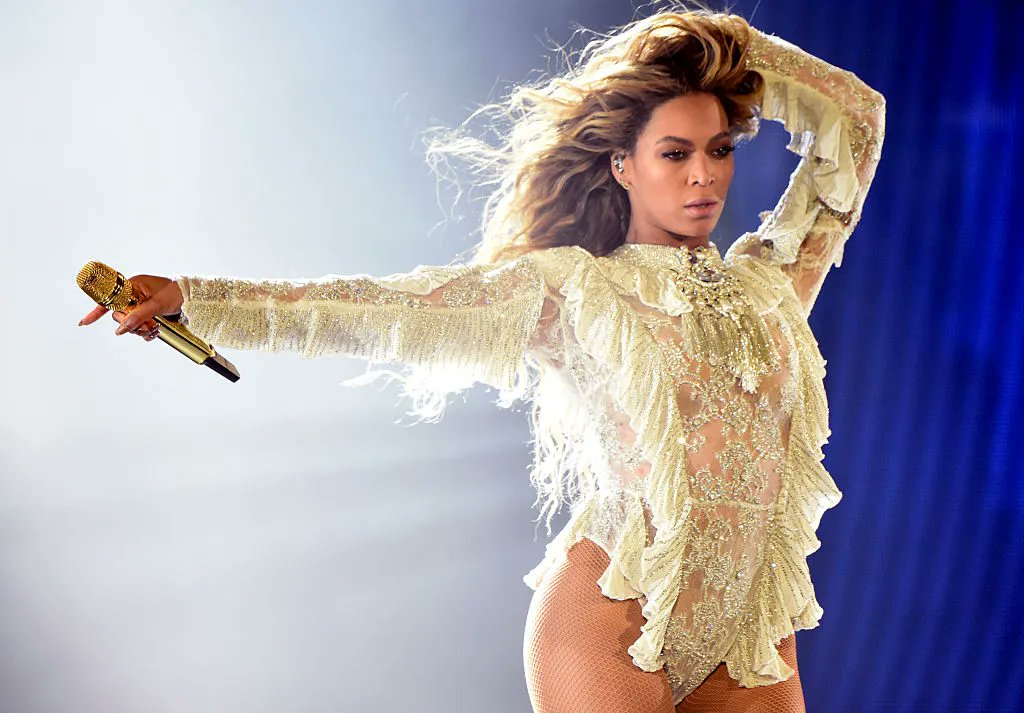

Do you suffer from imposter syndrome? Many high-performers do. This wonderful thread by Matt Schnuck breaks down a simple technique that superstars like Beyonce uses to overcome it.

February 15th 2023

|

One Resource:

If you are tired of getting a snarky response from the spreadsheet geek at work when you ask for help; Excelformulabot may be for you. It provides the formula you are looking for from a simple plain english request– all without the attitude.

One Quote:

|

|

More From Us:

👨🎓 Valuation Explained Simply is open for enrollment! Use the code COUNTMEIN300 to receive the biggest discount we will offer. (This code expires on Sunday, March 5, at 11:59 pm EST.)

📗 Brian Feroldi’s book is on sale.

.png)