🧠 Quality vs. Valuation

View Online | Sign Up | Advertise

Friends,

Few companies check as many boxes for us as investors as Intuitive Surgical.

For those unfamiliar, Intuitive Surgical invented robotic surgery. Its da Vinci system has become the gold standard device in its industry. It’s so popular that Intuitive holds a near monopoly position.

What makes Intuitive Surgical such an attractive investment is its killer combination of a wide moat and lots of optionality:

- Wide Moat: Hospitals put down $1.5 million for a da Vinci. Surgeons devote hundreds of hours training with it. Neither one has the time, money, or interest in switching to an alternative system.

- Optionality: As surgeons use da Vinci, they experiment. Over time, this has massively expanded da Vinci‘s use cases — a win for Intuitive, hospitals, and patients alike.

This combination has enabled Intuitive’s stock jump 14,600% since its 2000 IPO. It’s been one of the best stocks you could have owned over the past two decades.

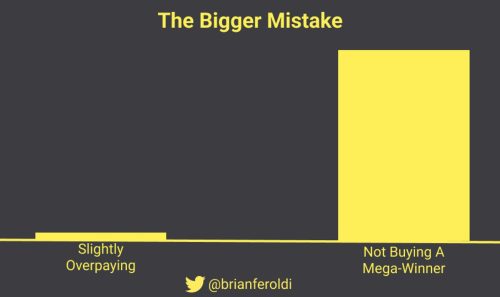

Despite all of the positives, we publicly debated the merits of investing in Intuitive Surgical in December 2022.

Why was there a debate? In a word: Valuation.

Based on the estimates we made using our reverse DCF calculator, at the time, Intuitive would have to grow its free cash flow by 28% per year…for ten years… to justify its price.

After some back and forth, we decided to hold our nose and allocate a small part of our portfolio to the business.

We bring this up because Intuitive Surgical came out with earnings recently. The company blew past all expectations. The number of procedures grew 26%, far faster than anyone was expecting. And analysts noted that the switching costs away from the platform were growing wider by the day.

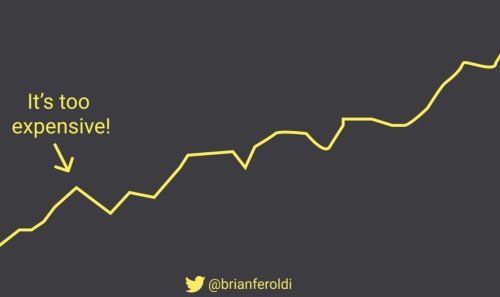

The results serve as a strong reminder that some companies with “expensive” stocks are valued that way for a reason: they create things no one else can, and the world wants more of what’s being offered.

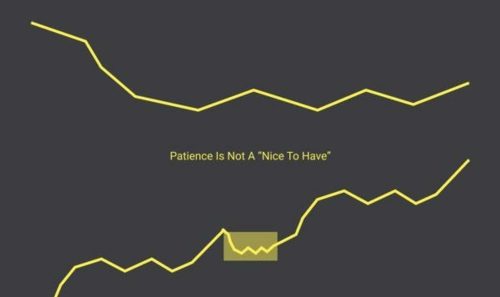

All of this is to say we’ve landed on an investing approach that helps us balance between business quality and valuation.

Business quality (i.e. “moat and optionality”) informs whether a company deserves a spot in our portfolio; valuation informs how much of the stock we feel comfortable buying.

That’s far from the only way to go about investing. But it’s what works for us.

Wishing you investing success,

– Brian Feroldi, Brian Stoffel, & Brian Withers

P.S. The next cohort of Financial Statements Explained Simply launches in May! We are hosting a free “Introduction To Accounting” webinar on May 5th. Interested? Join us. Can’t make it live? We’ll send all RSVPs a replay.

In Partnership with Tim Urban

A brand new framework for thinking about today’s complex world

What’s our problem? Get to the bottom of modern society with a groundbreaking new book from Tim Urban, creator of the wildly popular blog Wait But Why. Dive deep into history, evolutionary psychology, political theory, neuroscience and more as you explore an entirely new framework for understanding our complex world. Packed with original concepts, sticky metaphors, and hundreds of drawings, What’s Our Problem?: A Self-Help Book for Societies is sure to change the way you see your world.

One Simple Graphic:

|

|

One Piece of Timeless Content:

“…these are weird and trying times. It all makes you wonder what the point of stock-picking is.”

That’s how Drew Dickson, founder of Albert Bridge Capital, started A Memo to Investors. The rest of the article is a wonderful reminder about what it takes to succeed as an investor.

One Twitter Thread:

Having trouble falling asleep? This simple ritual can make all the difference:

June 6th 2022

|

One Resource:

Need a unique name for your club or business? Check out Namelix. This free tool allows you input data about your organization and it will generate a list of potential names for you to consider.

One Quote:

|

|

More From Us:

👨🎓 The next cohort of Financial Statements Explained Simply launches in May. Click here to join the waitlist and be notified when enrollment is open.

📗 If you’ve read Brian Feroldi’s book, he’d love a review.

👨🎓 The reviews of Valuation Explained Simply were fantastic! We are offering video replays. Interested? Click here to let us know.

|

.png)