🧠 The Secret To Longevity

Click here to read in browser.

Friends,

Susannah Mushatt Jones died in May 2016. She ate four pieces of bacon every morning for over half a century. It’s won’t shock you to learn that she had high blood pressure.

But this isn’t a story about unhealthy eating habits.

That’s because Jones was born in 1899. Yes — she lived for over 116 years.

Her bacon obsession and high blood pressure got lots of press at the time of her death.The rest of her life was unremarkable, so it received little attention.

Jones never smoked, never drank, slept for at least 10 hours per day, and surrounded herself with a supportive community. Those factors, we believe, were the real “secret” to her longevity (good genes probably helped, too).

Yet, if you only knew about her bacon obsession and high-blood pressure, you wouldn’t conclude that she was “healthy.”

But that’s the point: it’s a mistake to reach a complex conclusion by focusing on a single metric.

Someone might be able to run a 5-minute mile, but what if their joints are degrading and they don’t have any close friends?

Someone might have a healthy BMI, but what if they smoke and have digestive issues?

Someone might be able to squat 500-pounds, but what if they use performance enhancing drugs and have anxiety?

The same is true when we look at companies to invest in.

It sounds tempting to buy a company with a dividend yield of 6%. But what if that same company hasn’t grown its sales for 15 years, carries a mountain of debt, and has underperformed the S&P 500 for a decade (hello, AT&T).

We love shortcuts as much as the next investor. But AT&T — just like Susannah Mushatt Jones — reminds us of an important truth: there’s no replacement for taking a holistic view of the world around us.

Relying on a single metric to deem something “cheap” or “expensive” is easy. But that’s not how valuation works.

“Cheap” companies can still decline by 80% (ask General Electric’s shareholders).

“Expensive” companies can still 10x (ask Amazon shareholders).

We should know — we’ve made valuation mistakes many times ourselves.

Good investing boils down to buying quality companies at favorable prices and holding them as long as they stay great. That sounds easy enough, but consistently executing that strategy in the long-run is one heck of a challenge.

That challenge only gets harder when you rely on a single metric to make valuation decisions. We encourage you to take a more holistic view instead.

Wishing you investing success,

– Brian Feroldi, Brian Stoffel, & Brian Withers

In Partnership with ConvertKit

Newsletter Sponsorships Work

Guess what? You’re reading promotional content in a newsletter. Sponsoring influencer newsletters, like this one, is a great way to reach engaged and targeted audiences. It will build your brand — whether that is your personal brand or your business.

So here is the deal. This newsletter is part of the ConvertKit Sponsor Network (CKSN), representing more than 100 individual newsletter creators. Sponsor my newsletter and gain access to many more.

Sponsors Long-Term Mindset Now

One Simple Graphic:

|

|

One Piece of Timeless Content:

Block’s stock price has taken a step back this past week due to a short report from Hindenburg Research. A blog post from Multibagger Nuggets not only provides insights about Hindenburg’s report for investors, but takes a wider perspective on short reports in general.

One Twitter Thread:

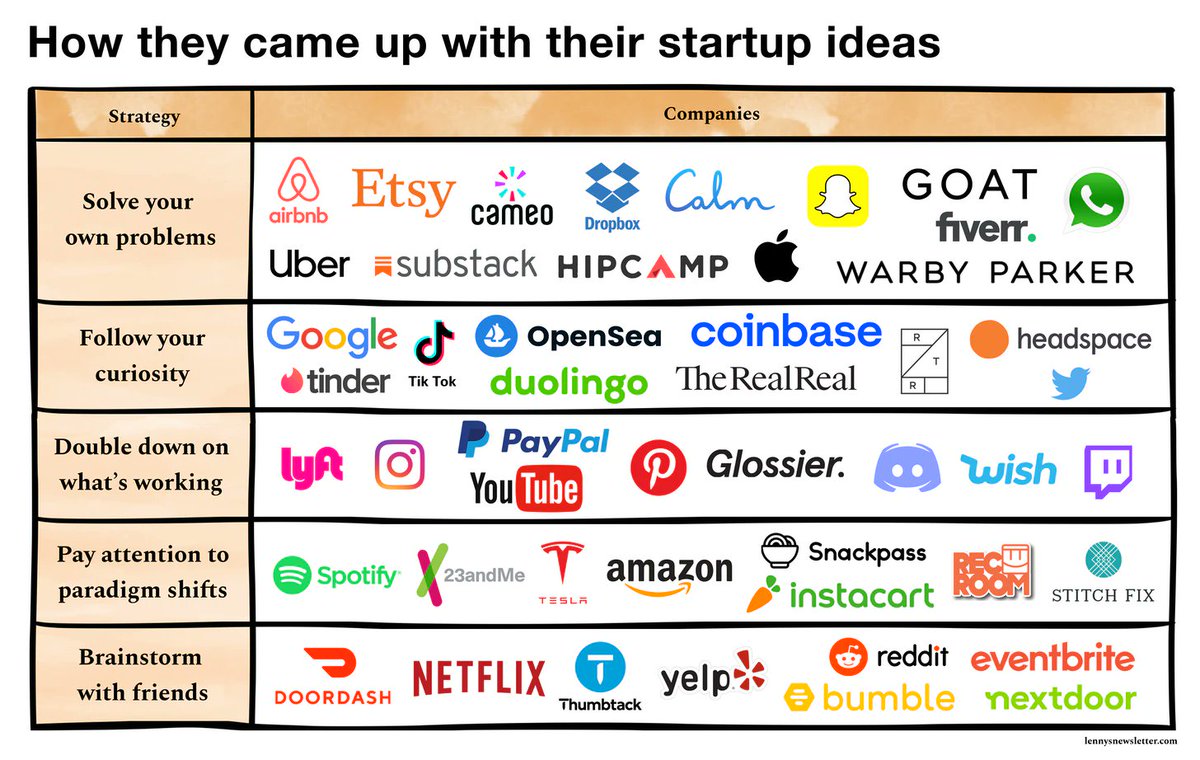

We love founder led businesses. How they got started is always interesting, but may not be how you’d expect. This thread from Lenny Rachitsky unveils some surprising facts about dozens of well-known companies.

July 11th 2022

|

One Resource:

Estimating how much you need for retirement can be complex; there are so many unknowns. This retirement calculator doesn’t just give you a single “magic number” that would allow you to retire to the life you want, but allows you to see a range of outcomes and the probabilities of each scenario based on a simple set of inputs.

One Quote:

|

|

More From Us:

👨🎓 The next cohort of Financial Statements Explained Simply launches in May. Click here to join the waitlist and be notified when enrollment is open.

📗 If you’ve read Brian Feroldi’s book, he’d love a review.

👨🎓 Want to learn more about valuation? Join the waitlist for Valuation Explained Simply.

|

.png)