🧠 This Tool Dramatically Reduces Investing Mistakes

View Online | Sign Up | Advertise

Friends,

In 2006, a Johns Hopkins anesthesiologist created a tool to help save lives. It was tested in 100 Michigan hospitals over 15 months. During that time, it saved 1,500 lives and reduced spending by $200 million.

The cost for every time the tool was used: $0.02.

In the history of medicine, there may never again be a more powerful, accessible tool to help the masses.

And what was that magic tool? It was a checklist.

The checklist had five simple tasks: washing one’s hands, clearing the incision site, draping the patient, using a surgical hat/gloves/gown, and applying a sterile dressing.

Each sheet of paper it was printed on cost $0.02.

We’re enamored with complicated, high-tech solutions. But more often than not, eliminating unforced errors is where the real gains can be had. That’s where checklists come into play.

In the hospital’s case, using the checklist cut infections from a 4% occurrence to zero. That’s remarkable.

The same dynamic applies to investing. Returns can often be improved dramatically by simply eliminating unforced errors.

Before you hit the “buy” button, ask if you have checked:

- Is the company’s gross margin stable or expanding?

- Is the company self-funding, or is it reliant on outside capital?

- Can you identify a durable competitive advantage?

These three questions alone could eliminate 80% of the potential investments you spend your time researching. It’s up to you to spend the rest of that time getting familiar with the choices left.

All three of us have created our own checklists — but none is the same. Stoffel’s only has nine items. Feroldi and Withers have much more.

But they all serve the same purpose: to eliminate stock ideas and minimize mistakes.

Over the long-term, eliminating these “unforced errors” — and focusing your time on the investments that are truly worthy — can make all the difference.

If you don’t have an investing checklist, make 2024 the year you build one. Your future self with thank you.

Wishing you investing success,

– Brian Feroldi, Brian Stoffel, & Brian Withers

P.S. – Want to learn more about what should be on your checklist in the New Year? Take our live course, Financial Statements Explained Simply. Starting January 8th. Click here to enroll with a $100 discount.

Together with Stock Advisor:

|

|

I’ve been investing for 19 years. For the first three years, I did it all on my own….and my performance was terrible.

In 2008, a friend showed me a recommendation writeup from Stock Advisor. It floored me. I was blown away by the quality of the research. It made me realize just how much I had to learn about investing. I became a paid subscriber soon after.

That decision was life-changing. If it weren’t for Stock Advisor, I would never have invested in Netflix, Amazon, or Mastercard….all of which have been monster winners for me. My investment in Netflix alone paid for my subscription cost 100x over.

If you’re still picking stocks on your own, I highly recommend adding Stock Advisor to your investing process.

| Try Stock Advisor Today! |

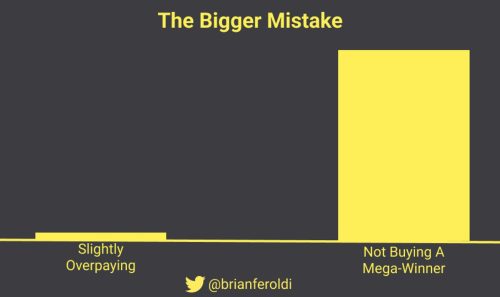

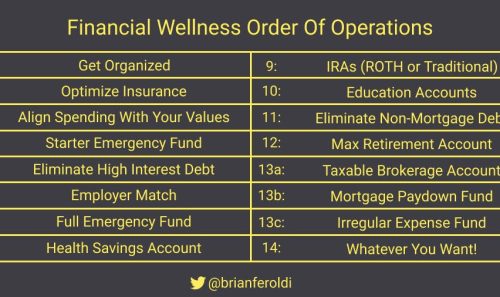

One Simple Graphic:

|

|

One Piece of Timeless Content:

We love businesses with wide moats. We also love businesses that can reinvest capital at high rates of return. What if a company had both of these traits? Saber Capital wrote about these rare companies in an article titled The Reinvestment Moat.

One Thread:

Want to build your own investing checklist? This thread contains a mega-list of questions you can use to get started:

|

One Resource:

Evaluating management and company culture is a part of our investing process. Not surprisingly, this study found that companies that treat their employees well perform better and provide shareholders with 2.0%-2.7% better returns annually!

One Quote:

|

|

More From Us:

📗 If you’ve read Brian Feroldi’s book, he’d love a review.

👨🎓 The next cohort of our flagship course, Financial Statement Explained Simply, is starting in January 2024! Click here to join us.