🧠 What it Takes to Get a 10-Bagger

View Online | Sign Up | Advertise

Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better.

Today’s Issue Read Time: <3 minutes

- Lesson: Aiming for “A Nice Little Life”

- Timeless Content: An investing mind hack

- Thread: SaaS metrics every tech investor should know

- Resource: Munger’s last public interview

- And more!

Today’s Newsletter is Brought to You by ConvertKit

Grow your email list passively

Add a new, passive list growth channel to your 2024 strategy with ConvertKit Recommendations. Set up your profile in the Creator Network and increase the chances of your content getting noticed and your subscriber list growing from recommendations of other creators— even when you’re out playing with your kids, grocery shopping, or setting up your next big launch. Just set it up and let it go.

| Start growing today |

Friends,

In 2013, author Laura McKowen went to her brother’s wedding. She got so blackout drunk she left her four-year-old daughter alone in a hotel room overnight. It was the wake-up call she needed.

She started attending AA meetings. And the refrain she heard from sober members — “I have a nice little life now” — left her angry and depressed. “Who the hell wants a ‘nice little life‘?” thought McKowen.

Motivated to do right by her daughter, however, she trudged on.

McKowen — now sober — has written a book about her experience: We Are the Luckiest. The title refers to how lucky she feels to have (wait for it…) “a nice little life now.”

What changed?

Wrapped up in the chaos of alcoholism, McKowen simply couldn’t imagine what that sense of gratitude felt like until it arrived. At the risk of equivocating the perils of alcoholism with investing, there’s an important lesson here.

When investors are getting started, they are often motivated by the success of others. Spend five minutes on Twitter, and you’ll hear others talking about their 10-baggers (we are just as guilty of this as everyone else).

But here’s what’s left unsaid: the process of getting that 10-bagger wasn’t exciting. There was no dopamine rush. It was painfully, excruciatingly boring.

We hit the “buy” button — and then we waited. Not for a day, or a week, or a month; it was years, sometimes decades!

Thankfully, we’ve arrived at a place where we can look at our portfolios and feel a sense of peace. Our investments have done well. Our families should be taken care of. We can sleep at night and feel the gratitude that comes from it.

But it can be a long haul to get there. The only way to make it: adopt a long-term mindset. It’s not as sexy or exciting as day trading or gambling. But it can lead to “a nice little life,” and we think that’s a great destination to shoot for.

Wishing you investing success,

– Brian Feroldi, Brian Stoffel, & Brian Withers

P.S. The next cohort of our Advanced Financial Statment Analysis course starts in March! Click here to get on the list to learn more.

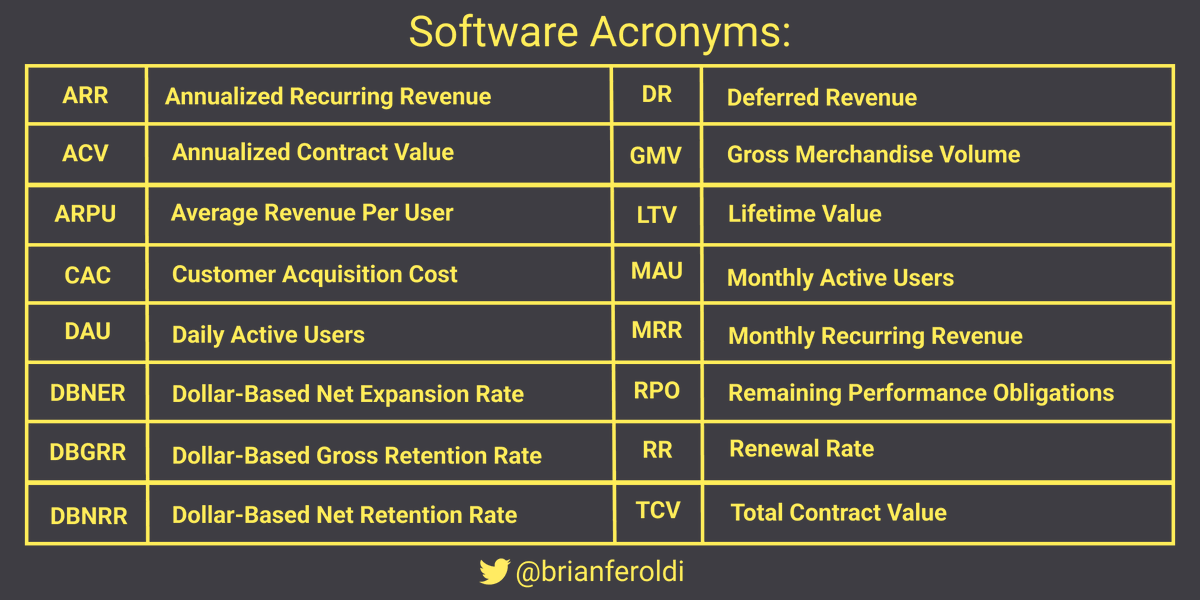

One Simple Graphic:

|

|

One Piece of Timeless Content:

Chris Mayer, author of 100-Baggers, shares a Jedi mind trick for how to extend your holding period. Check out his article here — it might be just what you need to hold the 16+ years it takes to achieve 100-bagger returns on average.

One Thread:

|

One Resource:

Charlie Munger, Warren Buffett’s right-hand man and long-time friend and partner, dispensed a wealth of investing wisdom over his lifetime. Check out his last public interview, where he explained why Berkshire Hathaway achieved success way beyond what the two ever expected.

One Quote:

|

|

More From Us:

📗 If you’ve read Brian Feroldi’s book, he’d love a review.

👨🎓 The next cohort of our Advanced Financial Statment Analysis course starts in March! Click here to get on the list to learn more.