🧠 Where The Gold Really Lives

View Online | Sign Up | Advertise

Friends,

Richard Nixon stepped down from office in 1974. He remains the only U.S. President to ever do so.

We might scoff at his name now, but it’s important to remember that Nixon was wildly popular back then.

In the 1972 election — just two years before he resigned — he won 49 of the 50 U.S. states and received 17 million more votes than his opponent.

It was a landslide victory in every way.

Years after his downfall, Henry Kissinger (Nixon’s Secretary of State) said:

Kissinger’s point has been reinforced many times over. Nixon had a tumultuous childhood.

Whether we see it in recent best-seller The Myth of Normal by Dr. Gabor Mate or in one of the all-time great movies — Citizen Kane, the havoc that unresolved psychological trauma can wreak on one’s life has been repeatedly documented.

What does this have to do with investing?

Well, depending on the culture where you’re reading this, not every society is as open to exploring and healing that trauma as others. Some try to tape over it with power (Nixon), others with money (Citizen Kane).

But it is only through connection — with ourself, something bigger than ourselves, with others — that such healing can take place.

Money and power don’t offer much direct help.

But, that’s not to say building up a solid nest egg can’t help at all.

Many people develop a strong sense of psychological safety by saving and investing. Creating a big financial buffer makes many people feel more confident in their ability to provide for themselves and their loved ones, even during periods of economic stress. That feeling can lift a burden from their mind so they can focus on developing those crucial connections with others.

Which, of course, is where the gold really lives.

This is one of the many reasons why the three of us are so passionate about investing.

It’s not because investing allows us to have more material stuff (although that’s a nice).

It’s because investing can help to remove finances as a barrier to us living a better life.

That’s what get us excited.

Wishing you investing success,

– Brian Feroldi, Brian Stoffel, & Brian Withers

In Partnership with Lili

The best online bank for freelancers and creators

Are you tired of dealing with traditional banks that don’t understand the unique needs of freelancers and creators? Look no further than Lili – the online bank designed specifically for people like you.

With Lili, you’ll have access to a range of features tailored to your needs as a creator, including:

- No account fees or minimum balance requirements

- Tools for managing your finances and tracking expenses

- Tax savings tools and advice from financial experts

- Instant payment notifications so you always know when you get paid

- Mobile check deposit so you can deposit your checks without leaving your desk

Plus, with Lili’s advanced security features and intuitive mobile app, you can rest easy knowing that your money is safe and secure. Don’t settle for a bank that doesn’t understand your unique business. Sign up for Lili today and start banking on your terms!

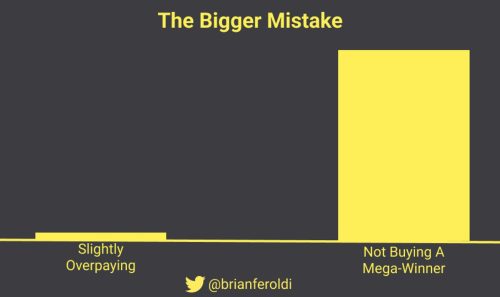

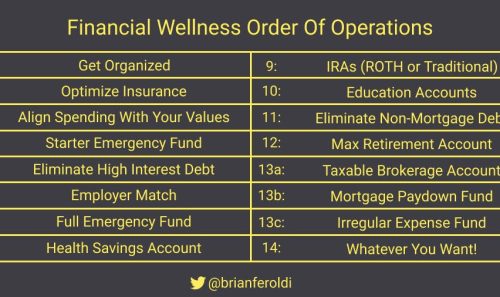

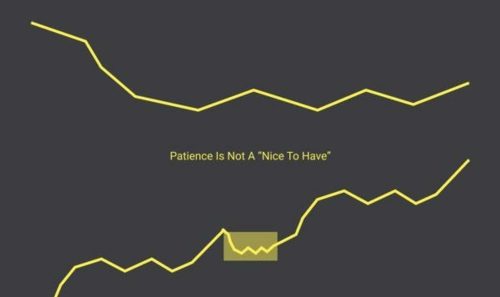

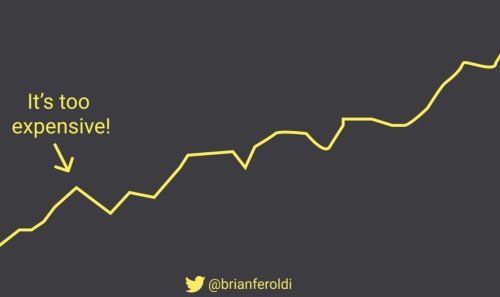

One Simple Graphic:

|

|

One Piece of Timeless Content:

Paul Graham is a programmer, writer, and investor. In a blog post titled How to Lose Time and Money, Graham explains how we can inadvertently squander our most precious resources and how to avoid doing just that.

One Twitter Thread:

Love him or hate it, Ramit Sethi is one of the most popular money influencers in the world. In this twitter thread, Ramit’s breaks down all of his personal rules for how he spends his money.

April 24th 2023

|

One Resource:

Do you like TED talks? You’ll love 99U. It’s a series of videos from creative leaders who are shaping the industries they work in. Topics include inclusive design, radical empathy, rethinking productivity culture, and more.

One Quote:

|

|

More From Us:

👨🎓 Missed out on Financial Statements Explained Simply? You can purchase the replays & materials here.

📗 If you’ve read Brian Feroldi’s book, he’d love a review.

👨🎓 Want to learn how companies are valued? Join the waitlist for Valuation Explained Simply.

|

.png)