🧠 Why Generalists Make The Best Investors

|

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today’s Issue Read Time: <3 minutes

Friends, Back in 1592, Robert Greene was an influential English author with his own pamphlet. Akin to today’s newsletter industry, Greene used his pamphlet to insult an under-educated industry newbie. Greene called him an “upstart crow…[who is] an absolute Johannes Factorum,” which translates to a “jack-of-all-trades.” It is from this sentiment that we get the insult: “A jack-of-all-trades is a master of none.”

The spat might have ended there. But that up-and-comer was William Shakespeare. We know whose side history landed on. The full quote — attributed to Shakespeare — now says:

“A jack-of-all-trades is a master of none, but oftentimes better than a master of one.” [emphasis added]

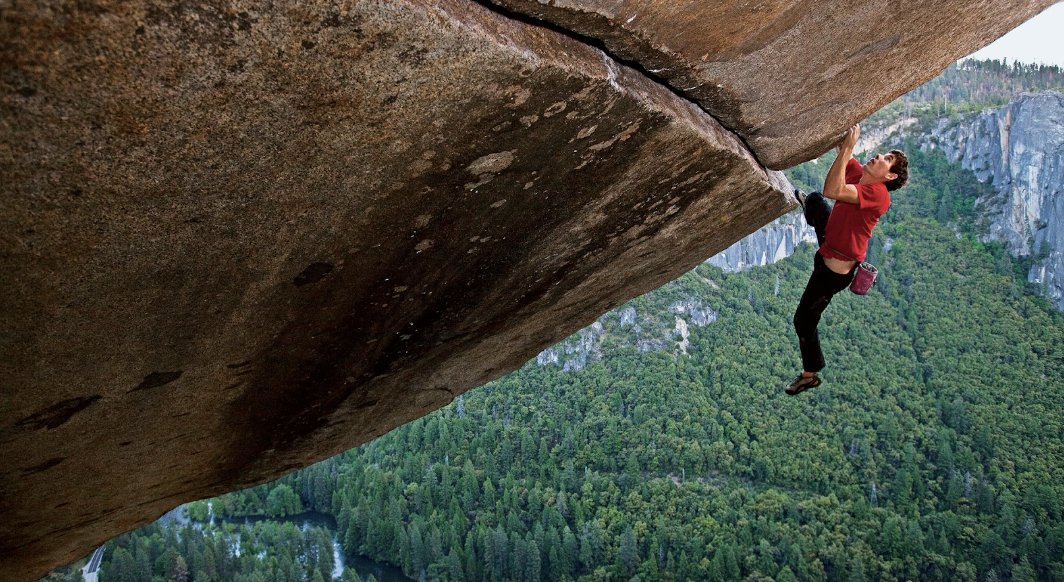

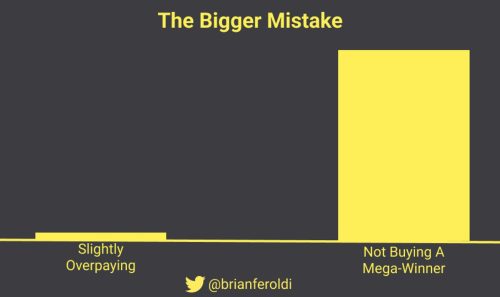

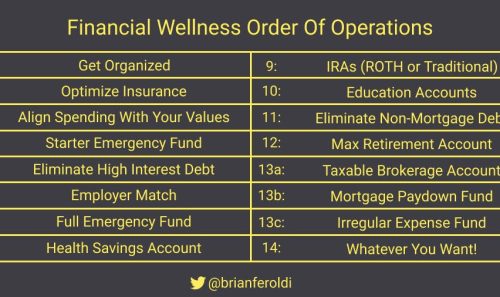

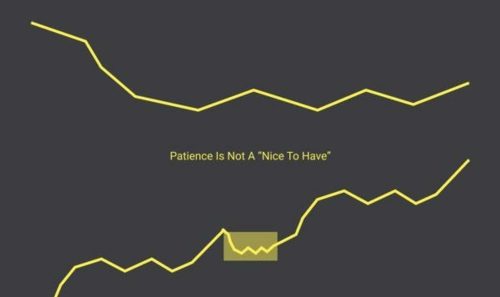

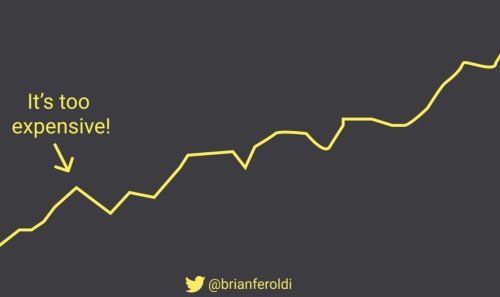

This story, recounted in David Epstein’s brilliant book Range: Why Generalists Triumph in a Specialized World, has important implications for investors. One of the toughest things about investing is that the feedback loop is painfully long. A stock’s movement within a year will largely be dictated by “market sentiment”. That’s code for: “the amount of dopamine (greed) or cortisol (fear) pulsing through investors’ veins.” It’s only over a much longer time frame that you can see if your investment thesis truly played out. That’s because business results — not market sentiment — have been the key driver of returns for decades. If you wait to learn these lessons from the market, it will take a while. But if you study biology, or physics, or evolution, or even athletics, you have access to fields with much faster feedback loops. You can notice patterns. You can get better at detecting the key driver of results and filtering out the rest as noise. Then, you can apply what you have learned to investing. That’s why — while we acknowledge the importance of valuation — we focus more on a company’s mission, growth, and margins. Over the long run, those are most likely to generate market-smashing returns. Spend at least as much time finding patterns outside of investing, and start seeing where you can apply the lessons you learn in your own portfolio. Wishing you investing success, – Brian Feroldi, Brian Stoffel, & Brian Withers One Simple Graphic:

One Piece of Timeless Content: Ever wonder why the stock market goes up? Brian Feroldi was recently on the How To Money podcast and answered that question plus discussed why stocks are the top-performing asset class, investing alongside psychopaths, and much more! One Thread:

One Resource: Interested in diving into earnings but don’t have the time? We’ve got you covered! On our YouTube channel, we break down some of the most widely followed stocks. Here are three from recent weeks that you might be interested in:

One Quote:

More From Us: 📗 If you’ve read Brian Feroldi’s book, he’d love a review. 👨🎓 The next cohort of our Valuation Explained Simply course starts in May! Click here for details. |