🧠 Your Unfair Advantage

|

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today’s Issue Read Time: <3 minutes

Friends, On April 24th, Meta (aka Facebook) came out with first-quarter earnings. By virtually every measure, it was a blowout quarter:

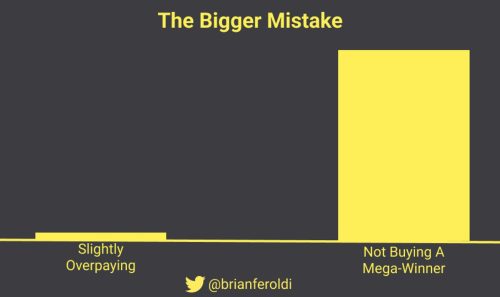

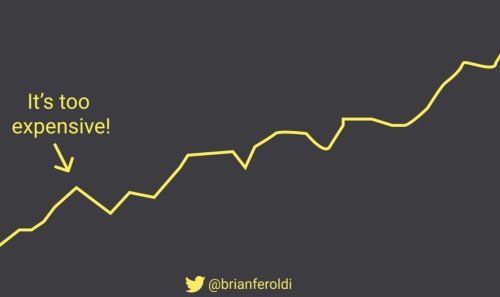

And yet, the stock plunged as much as 17% following earnings. While it is true that Meta’s guidance was a little lower than Wall Street was hoping for, it wasn’t markedly so. At the time, Meta was very reasonably priced. By our estimations, the company only needed to grow free cash flow by 11% annually over the next decade to justify where it traded. So, what was the culprit? CEO Mark Zuckerberg said the company would spend heavily on building out artificial intelligence (AI) capabilities over the next few years. Yes, the buildout will be expensive. At the same time, there are only a handful of companies that can afford the data centers and NVIDIA chips that power them right now. With $58 billion in the bank, Meta is one of the select few who can afford it. So why — knowing that Meta’s underlying business was so strong, that it had cash to reinvest in life-altering technology, and it had such a reasonable valuation — would the stock plunge? Because profitability would be harmed in the short term. And the vast majority of money traded on the market is with institutional investors. Those institutions can be fired by their clients at any given moment — their wealth taken elsewhere. They are optimizing returns over the next 90 days. But you, as an individual investor, have but one client to satisfy: yourself. And your time horizon can be over the next 90 years — giving you an incredible, unfair advantage over Wall Street professionals. It might seem like a small thing. But if you can buy shares of companies that are punished for trading short-term losses for long-term dominance, you can vastly outperform most investors. All you need is the ability & willingness to invest with a longer-term mindset than the rest of the market. It’s your biggest advantage. Don’t waste it. – Brian Feroldi, Brian Stoffel, & Brian Withers One Simple Graphic:

One Piece of Timeless Content: How does the stock market perform in an election year? Nick Maggiulli dives into the numbers to cover everything you need to know. One Thread:

One Resource: Should you in May and go away? James Brumley explores the history of this adage and whether investors should follow the advice. One Quote:

👋 What did you think of today’s newsletter? More From Us: 📗 If you’ve read Brian Feroldi’s book, he’d love a review. 👨🎓 Interested in learning to read financial statements like Warren Buffett? Check out our self-paced course, The Buffett Method. 🎬 Check out our YouTube channel! Last week Brian Stoffel covered the 5 stocks that make up 60% of his portfolio. |