🧠 Why Mega Caps Are Dominating

|

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today’s Issue Read Time: <3 minutes

Friends, We’re roughly halfway through 2024. The theme for the stock market this year is undeniable: it’s the year of the mega-caps — especially NVIDIA. If you combine the chipmaker with the six most valuable companies on U.S. markets not named NVIDIA (Microsoft, Apple, Alphabet, Amazon, Meta, and Taiwan Semiconductor), the group is worth nearly $16 trillion. To put that in perspective, this group is up over 50% in just one year’s time. If you weren’t invested in a handful of these companies, you’re likely lagging the market by a wide margin. Before now, many would have considered such growth impossible: “Once companies reach a certain size, there are limits to their growth, right?” For now, that turns out to be exactly wrong. And there are a few reasons for that:

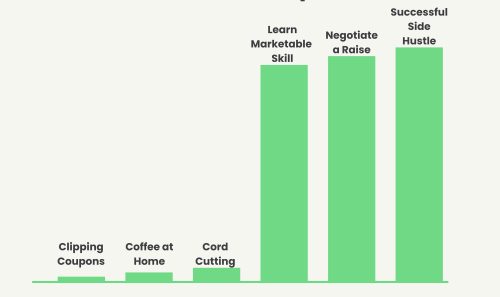

None of this means you should get out of these stocks. Take the long view. Many of these companies — while not cheap — are not outrageously priced. They are also in impressive financial shape. Over the long term, the important thing is that the valuation and the real-world results (free cash flow, net income, etc) have to grow in reasonable lockstep. When that’s the case, there’s no limit to how much these players can grow. – Brian Feroldi, Brian Stoffel, & Brian Withers P.S. Have you consumed any great investing content recently? If so, hit reply to this email and share the link. If we think it’s great, we may include it in a future issue (and give you a shoutout). One Simple Graphic:

One Piece of Timeless Content: Ben Carlson, portfolio manager at Ritholtz Wealth Management LLC, shares how he manages his own money. Warning: It’s boring! As he says, “Boring works for me because I think boring wins over the long run.” One Thread:

One Resource: Ramit Sethi, author of I Will Teach You to Be Rich, explains how to build a diversified portfolio. One Quote:

👋 What did you think of today’s newsletter? More From Us: 📗 If you’ve read Brian Feroldi’s book, he’d love a review. 👨🎓 Interested in learning to read financial statements like Warren Buffett? Check out our self-paced course, The Buffett Method. 🎬 Check out our YouTube channel! Last week, Brian Stoffel covered his 5 top most expensive and least expensive stocks. |