Balance Sheet Explained Simply

The Balance Sheet is one of the three financial statements investors must understand to analyze businesses.

The balance sheet formula is Assets = Liabilities + Shareholder Equity.

The balance sheet is kind of like a company’s net worth statement. It tells investors how much the company has in assets (e.g., cash, property), liabilities (how much money it owes to vendors, banks, and bondholders), and shareholder equity (its net worth on paper).

Like your net worth, balance sheets are measured at a specific point in time, such as December 31, 2022. ****They are a snapshot of a company’s net worth.

Just as you might determine your personal net worth by subtracting your liabilities from your assets, the balance sheet follows a similar formula to establish shareholders’ equity.

Like the income statement, the balance sheet uses accrual accounting. This means revenue & expenses are recorded when a transaction occurs, regardless of whether a payment has been made.

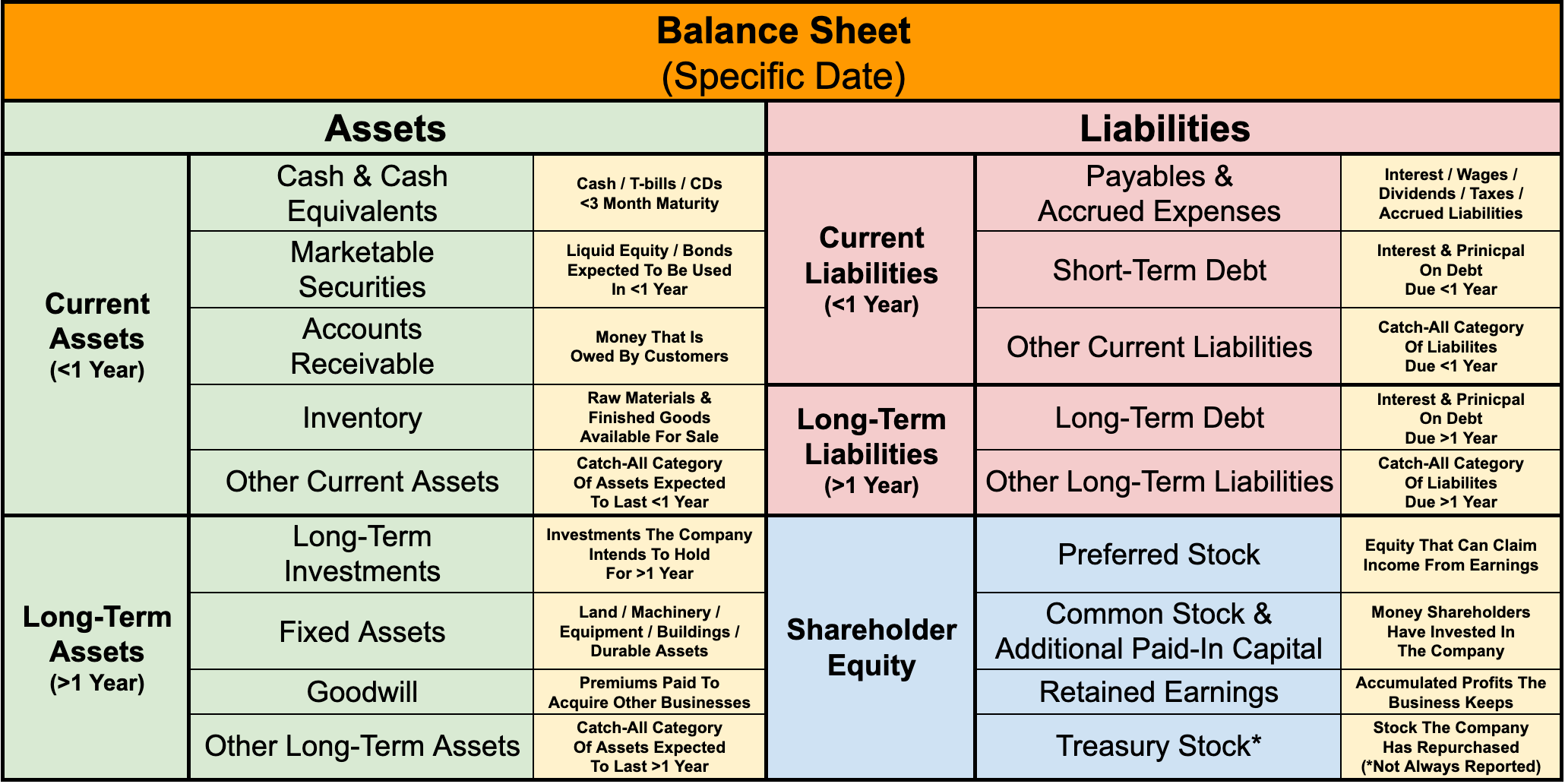

Here is the layout of a typical balance sheet:

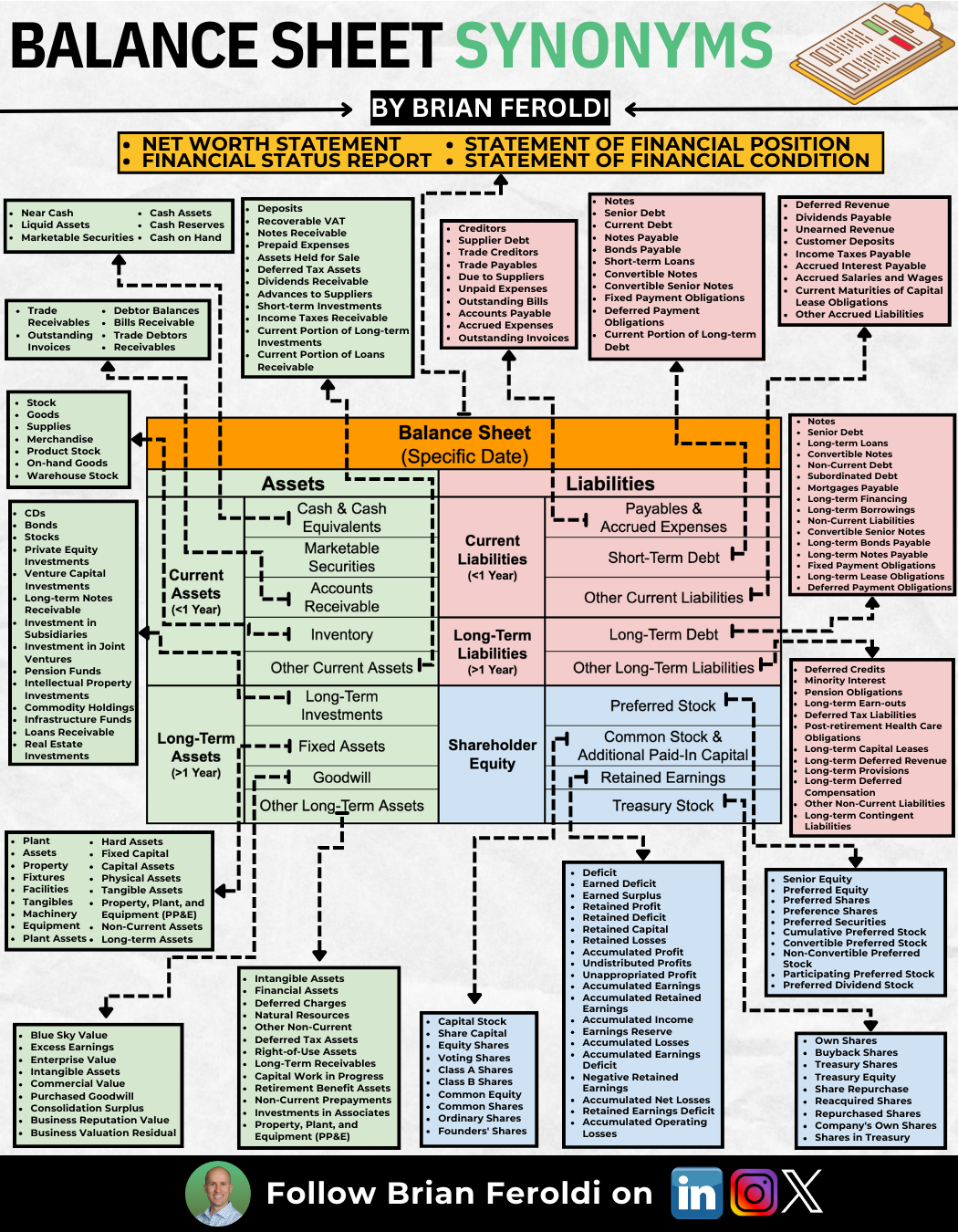

It is important to note that management teams have discretion over the language and terms on all their financial statements, including the balance sheets. This means balance sheets from different companies will almost always look slightly different.

Let’s take a closer look at the three broad categories of the balance sheet and explore why each is important:

Assets:

Assets are any item of property owned by the company that has value. Assets are ordered, from top to bottom, in order of liquidity, which means how quickly something can turn into cash.

Current assets are expected to be sold, used, or exhausted through standard business operations within one year. This includes assets like cash, accounts receivable, and inventory.

Long-term assets are expected to benefit the company for longer than a year. Long-term assets include tangible assets (things that can be touched) such as real estate, factories, and equipment. It also includes intangible assets (things that can’t be touched), such as goodwill from past acquisitions, copyrights, and patents.

Liabilities:

Liabilities are all of a company’s financial obligations owed to others.

Liabilities are ordered on the balance sheet from top to bottom regarding how soon the debt is due.

Current liabilities are bills due within the next year. This could include wages owed to workers, money owed to suppliers, and taxes owed to the government.

Long-term liabilities are debts not expected to be paid off in the next twelve months. This could include interest & payments on long-term debt, worker pension programs, and taxes that are not due in a year.

Shareholder Equity:

Shareholder equity is the equivalent of a person’s net worth on paper. This is the dollar amount that would be returned to shareholders if all of the company’s assets were liquidated and its debts settled. Alternatively, this is also referred to as a company’s book value.

The shareholders’ equity section of the balance sheet contains many useful categories for investors to look at. This includes retained earnings (the cumulative profits that a business has kept since its inception), additional paid-in capital (the money that shareholders have invested), and treasury stock (the value of shares that the company has repurchased).

As mentioned above, management teams have complete control over the layout and categories that they use when constructing a balance sheet. This infographic shows some of the other terms you may see:

In your search for investments, the balance sheet reveals whether a company borrows to keep the lights on or holds a hidden undervalued asset. Investors can learn if a company’s debt is worth more than its assets, giving it a negative book value. These are all important factors prudent investors should want to know before investing their funds in a business.

Understanding these key terms and how each was reached will help you become a better investor.