Introduction To Financial Statements

Imagine being a business owner and not understanding how much your company’s assets are worth.

Or, being a CFO who didn’t know the difference between net income and free cash flow.

While these scenarios are nearly unbelievable, it is just as vital for investors to understand how financial statements work as it is for company executives.

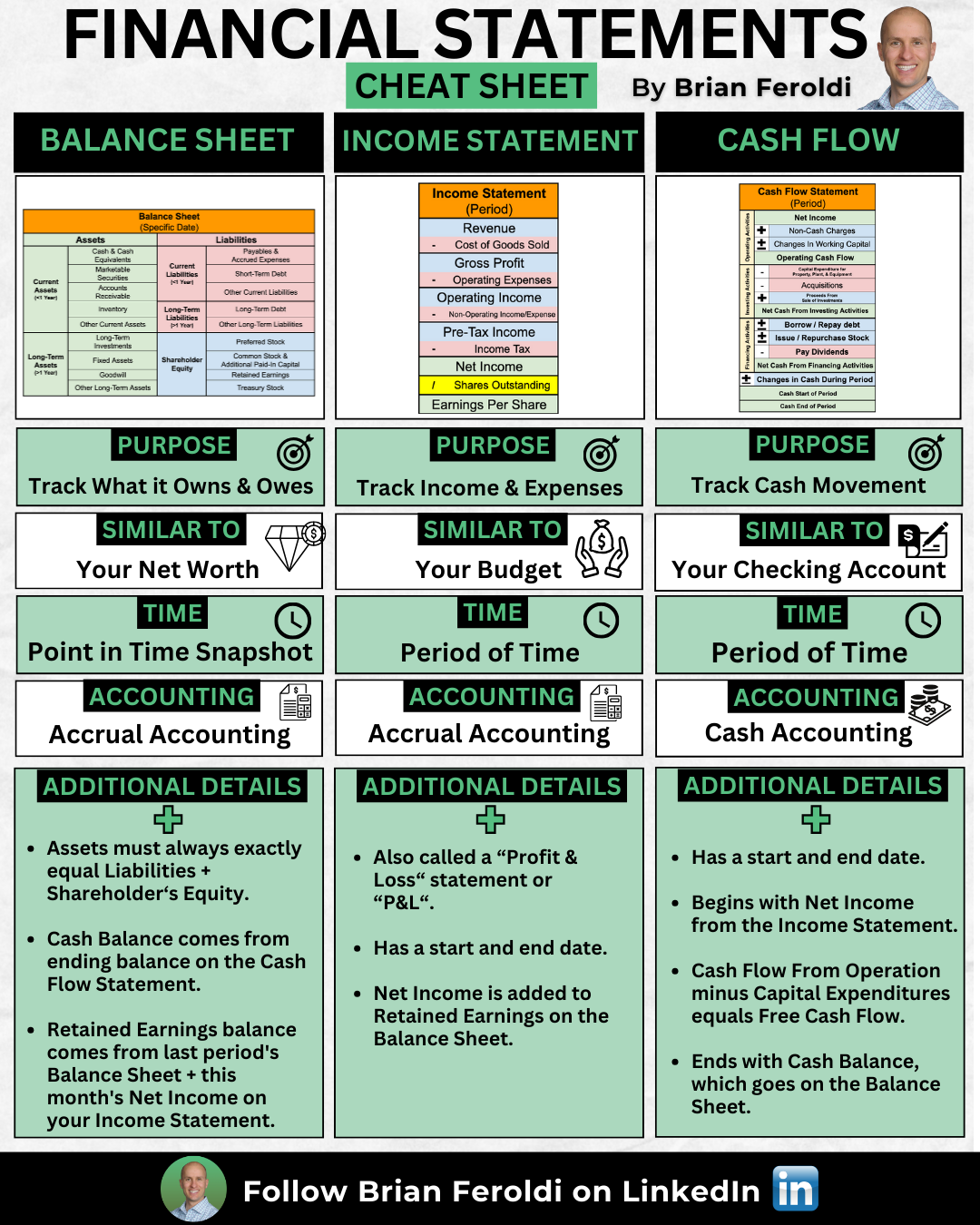

Every investor needs to be able to read and analyze the three financial statements companies provide to their shareholders:

- Income Statement

- Balance Sheet

- Cash Flow Statement

Let’s briefly review the purpose of these statements, why they’re essential, and the basic information each reveals.

First, we’ll start with the balance sheet, which tells what a company “owns” and what it “owes.”

Like your net worth, balance sheets are only for a specific time; they’re a snapshot of a company’s net worth.

What the company owns are considered assets (e.g., cash, property).

Assets are ordered, from top to bottom, in order of liquidity. In simple terms, that means how quickly something can turn into cash.

What a company owes are called liabilities. This could be how much money it owes vendors, banks, and bondholders.

Liabilities are similarly ordered from top to bottom regarding how soon the debt is due.

Lastly, a balance sheet shows shareholders’ equity. This is the net value of the owner’s claim, essentially a company’s net worth.

A balance sheet “balances” because the following formula is always true;

Assets = Liabilities + Shareholders Equity

Next up is the income statement. It details the results of a company’s operations over a period of time.

The income statement has a specific beginning and end date, typically measuring a company’s quarter or year.

The purpose of the income statement is to reveal whether a company is profitable. It provides three crucial figures for investors:

- Revenue: Total sales

- Expenditures: Total costs and expenses

- Income: How much profit was generated

There are many similarities between an income statement and your household’s budget. If I looked at your monthly budget, I would see how much money you make from your job or other sources. I would see all of your monthly expenses. What’s left would be your savings.

With a company, the income statement follows a similar model.

A company’s revenue, or sales, is all the money it makes by selling its products and services.

The company’s expenditures, such as supplier costs and employee salaries, are then subtracted.

The result is a company’s profit (if a surplus amount is left over) or loss (if its expenses exceed its sales).

Both the income statement and balance sheet use accrual accounting, which records revenue and expenses as transactions occur, not when the payment is received or made.

Lastly, the cash flow statement rounds out our key financial statements.

Its purpose is solely to track cash movements. In this way, it is like your personal checking account. Your checking account only cares about when money comes in and goes out.

Like the income statement, the cash flow statement tells investors what happened over a period of time, such as a quarter or year.

The cash flow statement is typically divided into three key sections: operating activities, investing activities, and financing activities.

Operating activities are the cash entering and exiting the company’s coffers through normal business operations. It can be helpful to think of this as the money needed to run your household, such as your grocery or utility bills.

Investing activities are the cash companies use to invest in and maintain their business, including capital expenditure and acquisitions. Think of this as the money required to remodel your kitchen.

Finally, financing activities are how a company’s cash flow has changed based on its actions with its bank. This includes borrowing money, paying off loans, and equity investments.

Unlike the income statement or balance sheet, the cash flow statement uses cash accounting, not accrual accounting. Cash accounting records sales when the money is received, and expenses are recorded as paid.

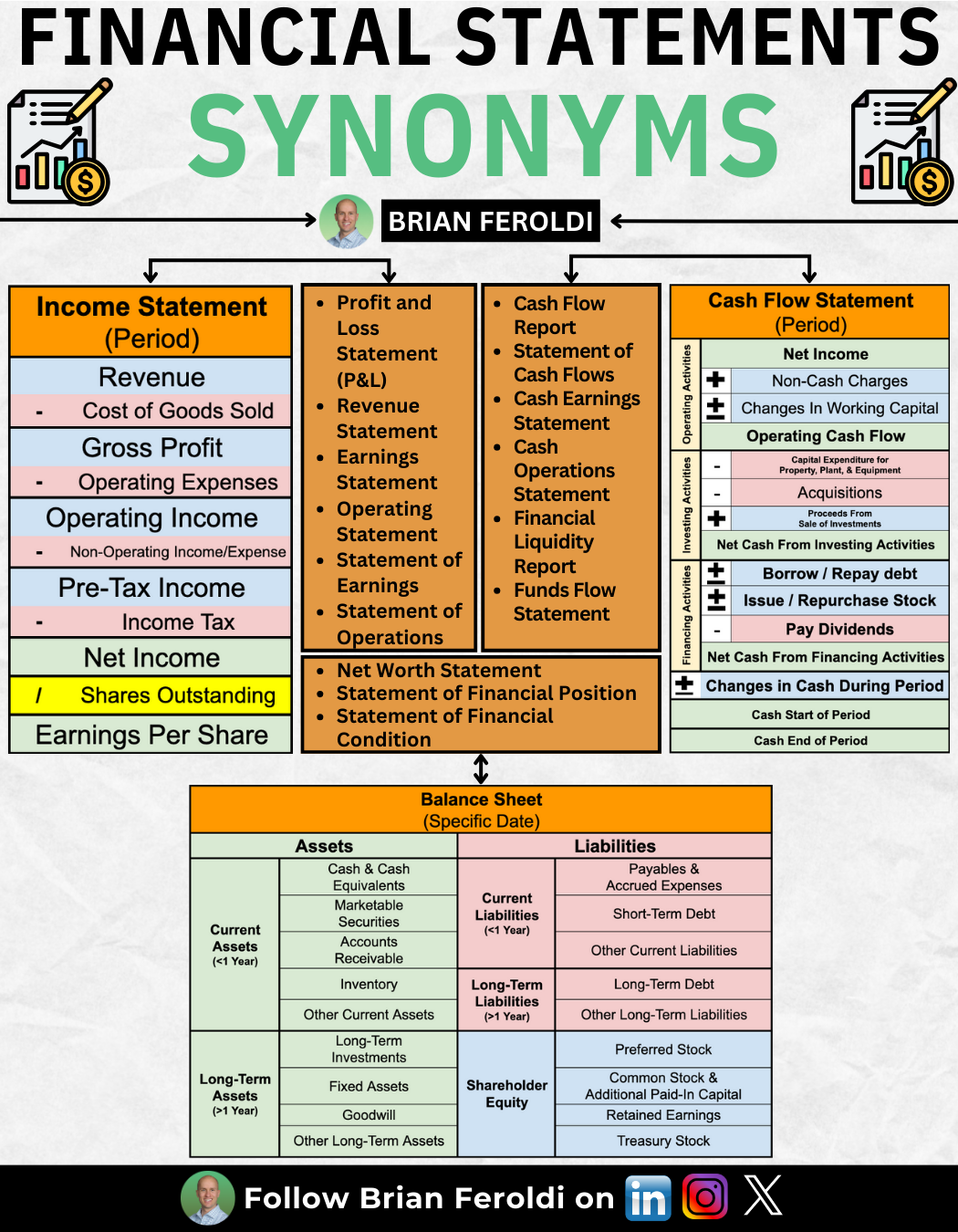

It’s important to note that management teams have full control over their names for the financial statement. This infographic shows some other names that you might see:

Once investors master reading and understanding the information these three important financial statements reveal, they will be well on their way to identifying winning and losing investments.