GAAP Vs. Non-GAAP Explained Simply

If accounting is the language of business, as Warren Buffett has said, it is essential to understand its high-level concepts.

Yet, when listening to insiders or stock market veterans, they often throw around the industry’s jargon and alphabet soup acronyms without explaining what each means.

One of accounting’s most confusing terms, which is crucial to understand when going through a company’s financial statements is GAAP, which stands for generally accepted accounting principles.

GAAP accounting is a commonly accepted set of rules and procedures designed to govern corporate accounting and financial reporting within the United States.

GAAP rules were jointly established by the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB).

This means that GAAP rules are applied to profitable corporations (overseen by the FASB) and government and non-profit organizations (regulated by the GASB).

This raises an important question: Why do companies report non-GAAP results if GAAP rules are for corporations?

Non-GAAP refers to accounting practices that do not comply with the GAAP standards.

Most companies report non-GAAP results to shareholders (in addition to their GAAP results) to add important color and nuance to their numbers that the GAAP standard misses.

However, it’s important to note that non-GAAP numbers can also be used to disguise weaknesses in a company’s results. It, therefore, takes a discerning investor to carefully comb through the numbers, comparing the GAAP with the non-GAAP results to see the accurate picture of companies’ finances.

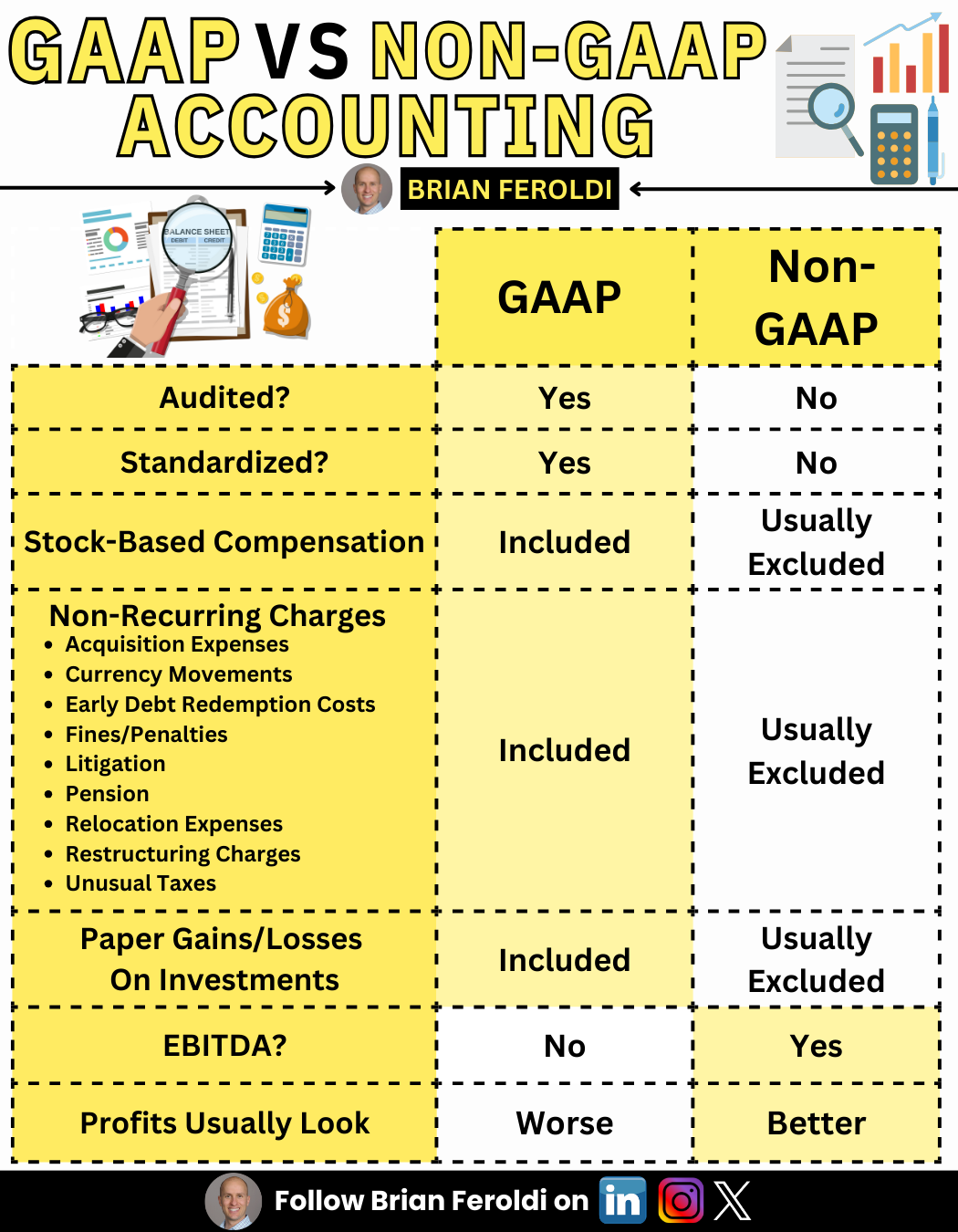

Here are some of the most significant differences between GAAP and non-GAAP accounting when companies report their results:

- Stock-based compensationUsing the GAAP standard, stock-based compensation (SBC) should be counted as an expense, causing a decrease in a company’s net income. On a non-GAAP basis, SBC is often excluded, boosting a company’s bottom line.SBC is a way of paying executives and employees with stock instead of cash.In theory, this aligns employee incentives with shareholders, as workers will be rewarded based on company performance.From a business’s standpoint, one of the most significant advantages of utilizing SBC is that it does not consume cash (it’s a non-cash expense).Under the GAAP standard, SBC is expensed in two places on the income statement: 1) Cost of goods sold (COGS), when it’s given to workers who created the product or service, and 2) Operating expenses, when it’s paid to executives, managers, sales, and other employees.By reporting non-GAAP results, companies can remove SBC expenses from these two lines, making profits look better.

- Depreciation and amortizationThese are two more non-cash charges that the GAAP standard dictates must be counted as expenses.Depreciation is the reduction in value of an asset that occurs over time. For instance, a new piece of factory equipment is worth more than it will be after years of heavy use.What depreciation is for a physical asset, amortization is its counterpart for intangible assets, usually financial instruments like a loan.Usually, when companies report non-GAAP results, they back out depreciation and amortization because no cash is leaving the company based on either of these metrics at the time it’s reported.

- Unrealized gains and lossesThis category recently gained the spotlight when some companies’ stakes in other companies showed a market gain or loss during a quarter.Take the case of electric vehicle maker Rivian Automotive. When the company went public in late 2021, it was revealed that Amazon was its largest shareholder. Even though Amazon might not have any plans to sell its stake in Rivian, it still must report any gains or losses of its Rivian stock on its income statement.Since unrealized gains or losses are non-operating, many companies exclude them when reporting non-GAAP results.

- Early debt payments

Finally, there are times when a company pays off debt early.This is a net positive for the company, but using the GAAP standard, the money used to pay off the debt early is subtracted from its net income.Using non-GAAP practices, not all losses must be subtracted from a business’s bottom line.